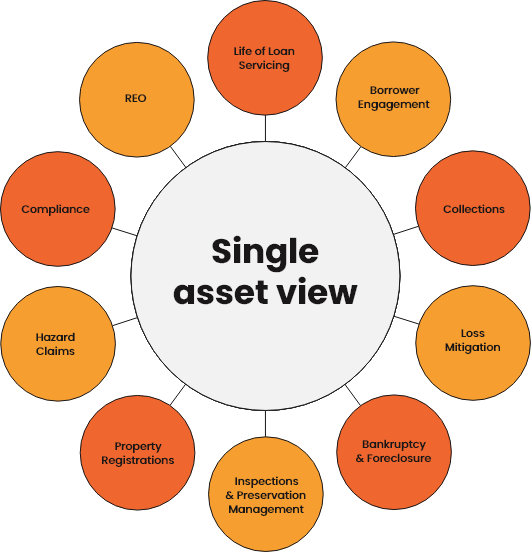

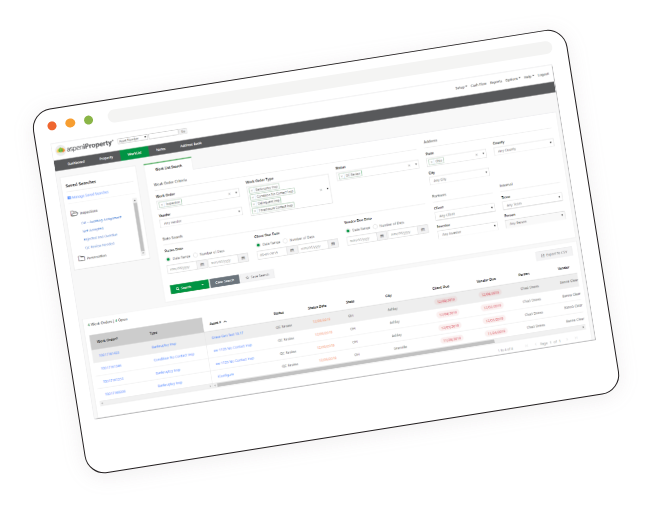

Standardize your mortgage servicing process while customizing workflows to your business needs. Our all-in-one dashboard makes it easy to coordinate and manage tasks for better business results.

Borrower engagement

Connect with borrowers quickly and on their terms. Our configurable borrower engagement solution digitizes loan services to provide borrowers with solutions for the entire homeownership journey. Retention and recapture just got easy.

Compliance

We offer the only industry-backed, fit-for-purpose standardized criminal background check. Provide real-time visibility of field personnel, along with a full audit history of each on-site visit to demonstrate compliance and trust. Our platform’s automated business rules can account for an unlimited number of compliance considerations, keeping your organization on-track and free of unnecessary penalties.

Collections

Unify underlying applications for the operator. Our collections product shortens onboarding time, eliminates manual checklists & improves compliance while shortening call times and systematically guiding operators through dynamic call flows. Eliminate after-call activities with real time data capture & interaction, resulting in reduced stress & anxiety for all parties.

Loss mitigation

Reach more qualified customers and ensure compliance with servicing rules. Our loss mitigation module coordinates the efforts of all of your loss mitigation team members, giving them access to the data they need to process applications correctly and efficiently—and it’s proven to improve process productivity.

Bankruptcy & foreclosure

Our bankruptcy module gives you all the information and materials you need to prepare accurate and complete proofs of claim, and to lift bankruptcy stays. At the same time, our foreclosure module enables end-to-end process tracking, resolving bottlenecks quickly and easily.

Inspections & preservation management

Manage your advance funding to spend only on the work orders you really need. Our platform reduces unnecessary outlays and significantly increases recoverability of advances. Our streamlined, efficient management solution can reduce advance spending by up to 75 percent—even as performance improves.

Property registrations

Ensure compliance with municipal property registration requirements. Our platform streamlines registrations through automated registration tracking, management, and completion, supporting compliance even across a geographically diverse portfolio.

Hazard claims

The hazard claims process often involves a high level of data entry, maintenance, monitoring, and coordination with property preservation teams. Our platform alleviates the resource demands by organizing all of the information and materials you need to submit a complete and fully-documented claim.

Capital repairs

Oversee the complex loss-draft process efficiently. With our loss draft module, you can collect and review all of the information and materials you need for speedy approval. Manage spending and repair timelines to maximize the value of these expenditures, and optimize spending while preserving the value of assets across your portfolio.

/Guardian%20logo.png)

To reduce the inefficiencies and headaches created by using the legacy financial software directly, Aspen Grove’s loss mitigation solution provided a new frontend that was placed over this legacy software, delivering an interface that updated this solution with modern, user-centric features and capabilities. The end result—a significant reduction in the manual labor and technical complexity required for managing any mortgage in default.

Only one servicing platform lets you standardize your processes while also building no-code solutions to meet your customized needs. Aspen Grove’s all-in-one platform connects all tasks, processes and stakeholders to align your mortgage servicing activities, allowing your operations reach new heights in productivity and performance.